Our cryptocurrency tribe — those who are in it for the long haul — grow weary of an extended downturn in our favorite asset class. Since we believe in the long term promise of crypto and Web3, it tests our resolve and frustrates us. Why did crypto winter 2022 come and when will it end? We’re not soothsayers by any means, but we’ll share our thoughts on what’s happened and what’s ahead. Just know that you need to be prepared for market chaos. Don’t panic…

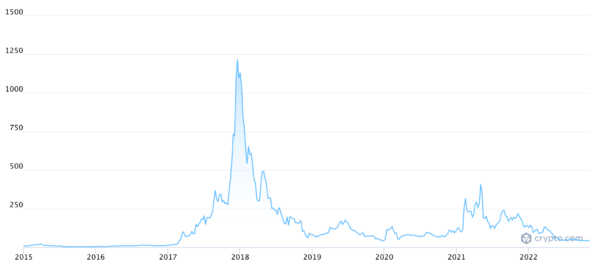

Crypto winters occur when prices contract and remain low over an extended period of time. Crypto winters have always hampered the crypto market. The last crypto winter spanned the time between January 2018 and December 2020. After that downturn, crypto markets soared, partly because central banks pumped so much liquidity into financial markets.

Benefiting from easy money, the crypto market entered a hyper-growth phase from 2020 through 2021. During that time, many new crypto projects appeared. Bitcoin was worth over $7,000 in January 2020. It rose to over $67,000 (800%!) by November 2021.

Origins of Crypto Winter 2022

Although there’s really no way to know for certain, we think a variety of factors impacted cryptocurrency markets.

Interest Rate Hikes

As a ‘remedy’ to aggressive economic stimulus policies and as a way to deal with rising inflation, the Federal Reserve tightened monetary policies.

Stock Market Decline

Cryptocurrency is a new (risk) asset class. When there’s a broad stock market decline, we see heavy selling in crypto. Think “margin call” and the adrenaline surge to an investor who suddenly has to cover his bets.

2021 Hype

Some folks blame the current winter on overhyped non-fungible tokens (NFTs) and NFT marketplaces. If you paid over $400,000 for a Bored Ape NFT in 2021, chances are you’re feeling the pain of purchasing an overpriced digital collectible. The exuberance of the good times often leads to overhype.

The 4-year Bitcoin Halving Cycle

After every 210,000 blocks mined — every four years or so — the block reward for Bitcoin miners who process transactions reduces by half. The last three Bitcoin halvings took place in 2012, 2016 and 2020. Bitcoin halving is typically accompanied by turmoil.

Scandals

As all these external factors unfolded, we also saw some uncertainty within crypto. First, news broke of the de-pegging of the algorithmic TerraUSD stablecoin. Later, we had the Celsius scandal. Liquidation of hedge fund Three Arrows Capital highlighted the emerging connection of projects and companies in the marketplace.

Crypto Winter 2022 and the Impact on Dash

The market cap of the top 100 cryptocurrencies fell 62% between November 2021 and August 2022 — down from $2.7 trillion to $1 trillion. The people & companies behind cryptocurrencies face difficulties too. During bull markets, many projects and cryptocurrencies enjoy eye-popping growth. During bear markets, weaker projects drop out and innovative ones grow. The cryptos that survive bear markets can emerge stronger than before.

Dash cryptocurrency was not immune during crypto winter 2022. Its USD price fell from over $230 to under $40, nearly an 80% drawdown. Such a precipitous decline begs the question: what lies ahead for Dash? As we’ve written before, the roadmap ahead is all about Web3. This shakeout may eliminate poorly implemented coins, but payments are only one tenet of what blockchains will provide. Supplying any part of the foundation of Web3 dApps increases the odds for long-term success. Of course, that would fuel more investment in Dash.

When Will Crypto Winter 2022 End?

If history repeats, crypto winter 2022 could end between December 2022, and February 2023. But we face a daunting inflationary trend with few remedies available. More interest rate hikes loom, which only pours salt in the wound of this crypto winter. Meanwhile, Dash development moves forward, fueled by the Dash treasury (not outside investment), which can lead Dash through to the next bull market. It’s survival of the fittest cryptocurrencies…

Leave A Comment